Accounting 101: the Profit & Loss Statement

Understanding your business primarily revolves around understanding 2 financial statements: the Profit & Loss (or Income Statement) and Balance Sheet. Here’s what you need to know about the Profit & Loss.

Profit & Loss

The Profit & Loss (or P&L, or Income Statement) is the fun one. It’s the one that says, “how much money did I make?” The phrase “the bottom line is…” comes from this statement because we have a tendency to just look at the bottom line, which is our profit (or, unfortunately, loss). But there’s so much more juicy information on the statement!

The basic premise of this financial statement is Sales - Expenses = Profit.

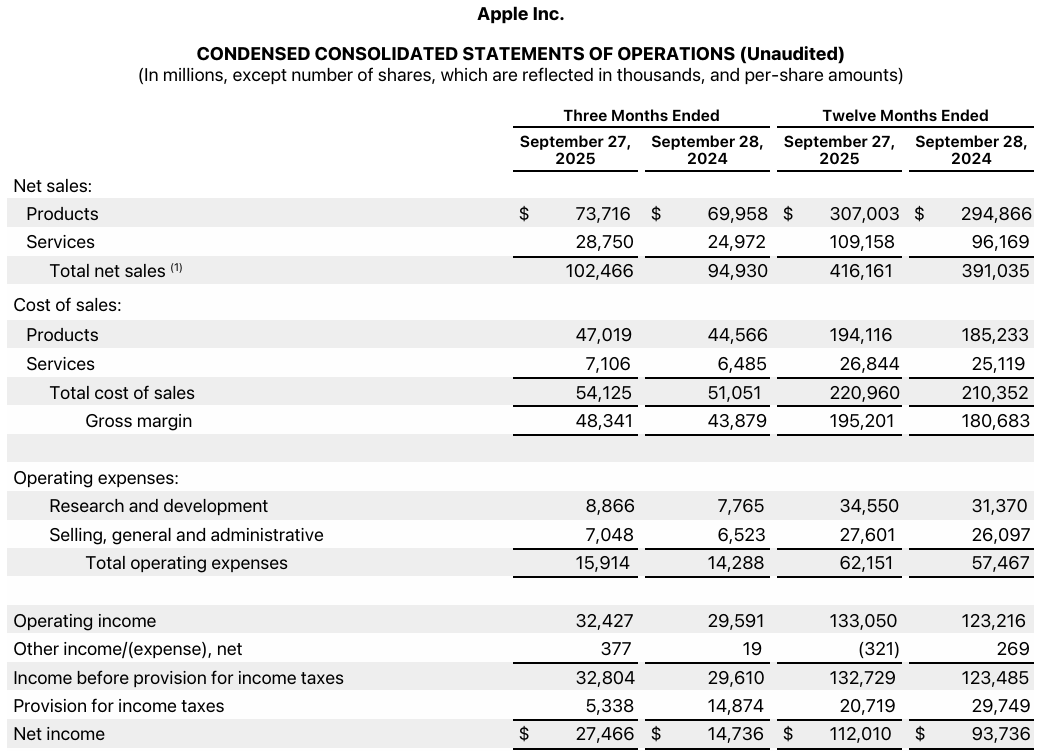

We’ll use Apple’s 2025 Income Statement as an example (available on their website).

The first thing to note is the P&L covers a period of time, usually a month, quarter, or year. In Apple’s case, they are showing both the most recent quarter of activity and the whole year. Also, just a side note, Apple’s P&L is in millions so add 3 zero’s to all of these numbers! And dream big.

You’ll find Revenue or Sales at the top of a P&L. This is the total money coming into the business. It’s also what many small businesses refer to when talking about the size of their company, i.e. “I run a million-dollar company.”

Next is any Cost of Sales. These are costs directly attributable to the sales. If Apple sells an iPhone, the cost of making the iPhone (materials and labor) would be in Cost of Sales.

Which brings us to Gross Margin. This is how much money you made from your products or services. It’s nice to know, but where it really becomes helpful is as a percent of Sales. You’ll want to research your industry to see what a “good” Gross Margin percentage (GM%) is because that percentage varies dramatically based on your industry. For example, software companies tend to have a higher GM% - 75% or more - since there’s not really a cost of the product. Once the software is made, you can sell as many copies as you want. Construction, the industry I have a background in, tends to have lower GM%’s - closer to 20% - because a significant portion of your Revenue goes right to the cost of materials and labor. That’s why GM% needs to be viewed based on your industry, a lower GM% isn’t inherently “bad,” it’s just a different business model.

Next on the P&L you’ll find Expenses. Most small businesses will focus on Selling, General and Administrative expenses (Apple also has a fancy R&D line since they spend so much on it). This includes all your other expenses, from payroll to marketing to office rent. As a small business, you’ll want to request these sub-categories be broken out on your P&L (unlike Apple) so you can really see where your money goes. Smart business owners review these accounts regularly for optimization.

Finally, we get to the bottom line, formally known as Net Income but also goes by profit, earnings, take-home pay, cheddar, and (if you’re fancy) EBITDA (EE-bit-dah). As an industry pro, I feel obligated to point out that EBITDA is technically something else, but you may hear your colleagues use the term and it’s close enough for jazz.

Profit is the number we get excited about. It’s the money you get to pay yourself with or invest in your company for future growth. More profit is typically more better (sic). But again, it’s relative. If you made $100K profit this year from $200K of sales, you may be happy with that. If Apple made $100K profit from their $307M of sales, they would be very unhappy.

This post covers quite a bit of information. If you’re feeling overwhelmed, hiring a bookkeeper who can walk you through your P&L (and deliver it right to your inbox monthly) is a great start.

And, just because you make a profit doesn’t mean you’re making money. That requires a Statement of Cash Flows.