Accounting 101: the Balance Sheet

Understanding your business primarily revolves around understanding 2 financial statements: the Profit & Loss (or Income Statement) and Balance Sheet. Here’s what you need to know about the Balance Sheet.

Balance Sheet

The P&L may be the fun financial statement, but the Balance Sheet really shows your business’s financial health. It shows everything you own and everything you owe.

The basic premise of this financial statement is What You Own = What you Owe + Your Investment In The Business.

That’s why it’s called the Balance Sheet - your Assets (what you own) should match your Liabilities (what you owe) plus Equity (your investment).

This is also the language of accounting. Any skilled bookkeeper or accountant will think of every transaction in terms of the Balance Sheet. I’ll explain this later as it’s key to mastering your business.

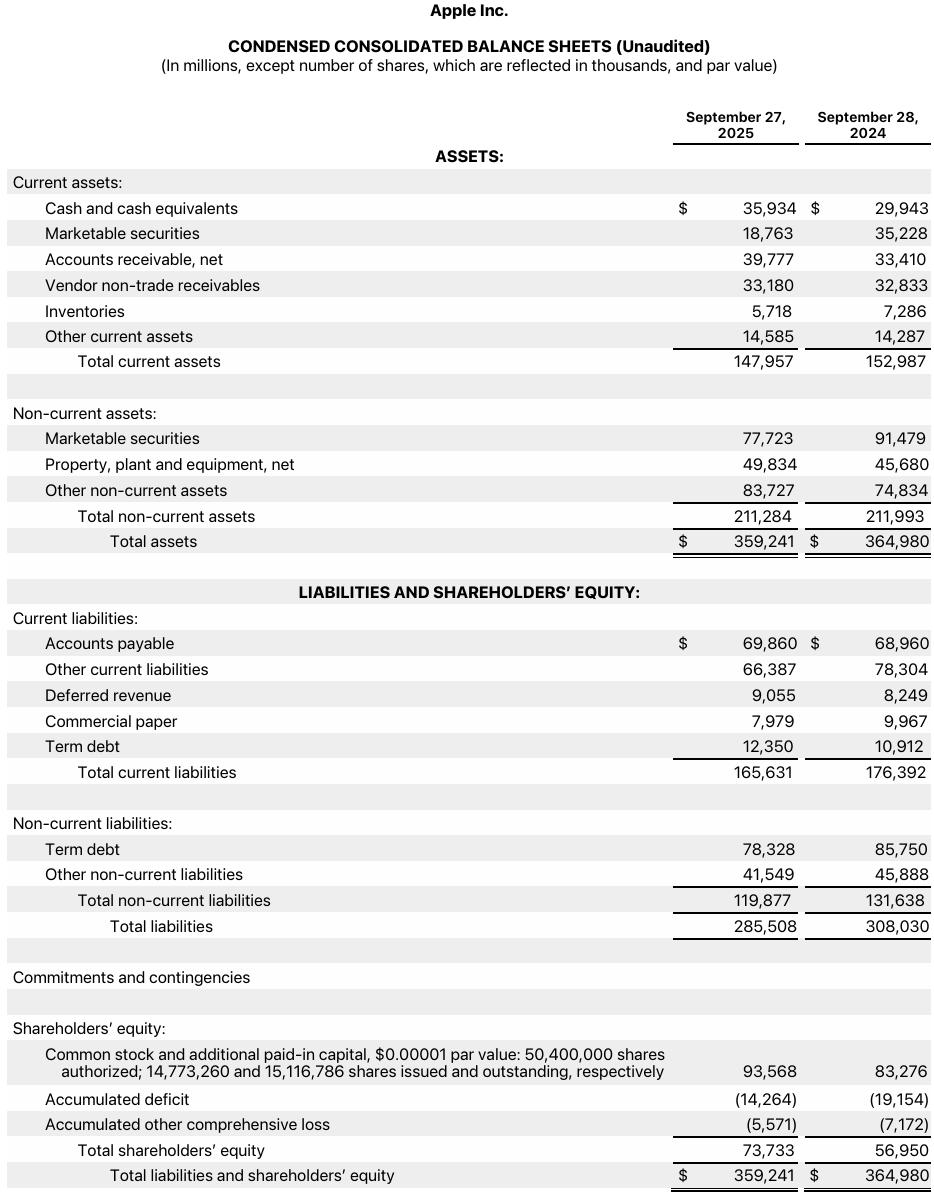

We’ll use Apple’s 2025 Balance Sheet as an example (available on their website).

And just as a reminder, Apple’s Balance Sheet is in millions so yeah, that’s $36M in cold, hard cash. Must be nice.

You’ll notice that, unlike the P&L, the Balance Sheet is a point in time rather than a period. It’s a snapshot of your business right now.

The top side is your Assets, or what you own. Think of everything you control, so cash, inventory, equipment, real estate, etc. It can also include intangible assets which are things you can’t physically touch (like intellectual property), but most of us will focus on the tangible assets, the stuff we could show off in an MTV show.

The bottom side starts with Liabilities, which is everything you owe. Any loans or mortgages would go here, along with any Accounts Payable (when you’ve received a bill but haven’t paid yet). This is all your various forms of debt.

The second part of the bottom is Equity, which is your investment in the company. This could be some seed money you put in your business accounts to start with, or it could be profit you rolled back into the business, meaning revenues increase equity and expenses decrease it. At the end of the day, this is considered the “book value” of your company which is kind of like the scrap value of a car. Hopefully your car is worth a lot more, but even a junker is worth the value of the metal.

So, going back to the beginning, why is this the language of accounting? The Balance Sheet works because all transactions affect 2 parts of the formula (Assets = Liabilities + Equity). For example it could work on Assets and Liabilities. Did you pay a bill? Lower Cash and lower Accounts Payable. But it can also work with offsetting amounts on the same side of the formula. Did you buy inventory? Increase Inventory, decrease Cash.

Confusing? Then it might be good to hire a bookkeeper because any transaction that breaks the formula leads to inaccurate financials.